Contents

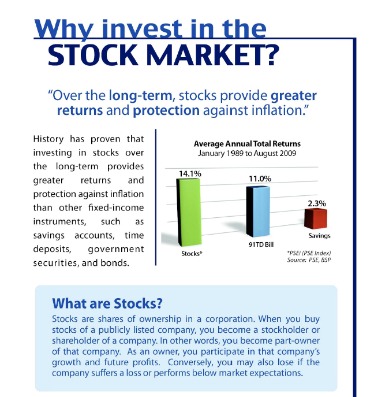

With help from a financial advisor you can trust, you can get a better handle on the stock market and start investing for your future. That’s why it’s so important to have a long-term view when it comes to investing. Dividend capture is a strategy where short-term investors buy stocks before the ex-dividend date and sell on or after the ex-dividend date. Both stocks and bonds play a complementary role in building a diversified investment portfolio. Buying both stocks and bonds helps investors capture market gains and protect against losses in a variety of market conditions.

The first stock market was the London Stock Exchange which began in a coffeehouse, where traders met to exchange shares, in 1773. In general, the two market indices are reflective of stock market sentiments. For example, investors are considered to be optimistic about the economy’s prospects if the indices move upward and vice versa. Depending on trading volume and economic conditions, stock markets can be bellwethers of the broader economy. Stock markets began as physical locations where traders gathered buy and sell shares but most trades are now conducted online.

How does the stock market work?

Investors must carry out the transactions of buying or selling stocks through a broker. In a nutshell, a broker is simply an entity licensed to trade stocks on a stock exchange. A broker may be an actual person whom you tell what to buy and sell. More commonly, it is an online stock broker — say, TD Ameritrade or Fidelity — that processes the entire transaction electronically. If there is a lot of demand for a stock, investors will buy shares quicker than sellers want to get rid of them.

But the Amsterdam Stock Exchange , which was established in 1602 by the Dutch East India company, is credited with popularizing stock trading. For reverse situations, that is when prices move upward for a significant stretch of time and investors embrace risk, the market is said to be in bull territory. If a serious investor is unable to outperform the benchmark , then it makes sense to invest in a low-cost index mutual fund or ETF. That’s a basket of stocks whose returns closely align with one of the benchmark indexes. You should also read up on the best apps for trading stocks, and how to manage your risk. Stock trading is a form of investing that prioritizes short-term profits over long-term gains.

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. Last-sale reporting is the submission of details about the quantity and price of a stock trade to Nasdaq within 90 seconds of the trade’s close. The Buttonwood Agreement, so named because it was signed under a buttonwood tree, marked the beginning of New York’s Wall Street in 1792. The agreement was signed by 24 traders and was the first American organization of its kind to trade in securities.

Conversely, investing in the stock market for the long-term has proven to be an excellent way to build wealth over time. The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments. Online or “discount” brokers like E-Trade, Merrill Edge, or TD Ameritrade charge no fees for trading stocks and small fees for some other purchases such as mutual funds. A new generation of app-based brokers including Robinhood and Acorns also has emerged.

For example, you now have a say in how the https://en.forexbrokerslist.site/ is run, you’ll get a small cut of the company’s profits , and your shares become more valuable as the company grows over time. In some markets, you can capture the dividend without the stock suffering too much of a hit on the ex-dividend date. But in declining markets, the dividend payout might be negated by the stock price dropping on the ex-date. If a company declares a stock dividend of 5% and you hold 100 shares of that company, you’d receive five additional shares of stock, bringing your holdings to 105 shares. However, the value of each outstanding share would decrease by 5%, making the value of your shares the same.

When https://topforexnews.org/s fall that much or more in one day, it’s known as a stock market crash. The history of stock market crashes shows this is a regular occurrence. If investors think the economy is slowing or stagnant, they may instead invest in bonds, which are a safer investment, although they do come with their own risks. Bonds give a fixed return over the life of the loan and typically do well during the contraction phase of the business cycle. We have taken reasonable steps to ensure that any information provided by The Motley Fool Ltd, is accurate at the time of publishing. The content provided has not taken into account the particular circumstances of any specific individual or group of individuals and does not constitute personal advice or a personal recommendation.

What Is a Stock Market Index?

Each exchange is tracked by an index, while global indices track stock performance across borders. For example, the MSCI Index tracks the performance of stocks in emerging market countries such as China, India, and Brazil. On the other hand, mutual funds are less likely to see dramatic rises, whereas some individual stocks may do. The benefit of individual stocks is that a careful choice can bring vast profits, but it’s unlikely that an individual stock will make you a millionaire. A stock market index displays how investors believe an economy is performing.

It’s important to note that that historical return is an average across all stocks in the S&P 500, a collection of around 500 of the biggest companies in the U.S. It doesn’t mean that every stock posted that kind of return — some posted much less or even failed completely. Dividends are payments made to shareholders out of the company’s revenue, and they’re typically paid quarterly. When you buy the stock of a company, you’re effectively buying an ownership share in that company. Click the link below and we’ll send you MarketBeat’s guide to investing in 5G and which 5G stocks show the most promise.

No content should be relied upon as constituting personal advice or a personal recommendation, when making your decisions. If you require any personal advice or recommendations, please speak to an independent qualified financial adviser. Should you invest, the value of your investment may rise or fall and your capital is at risk. Before investing, your individual circumstances should be assessed. The stock market is made up of over-the-counter , electronic and stock exchange trading.

While 3M currently has a “Hold” rating among analysts, top-rated analysts believe these five stocks are better buys. Having to please shareholders each quarter makes it more difficult to exercise long-term plans and strategies. Public companies can reward employees with stock options, allowing them to attract top-tier talent.

Who regulates the stock market?

Owning stock means you’re trusting the company’s leaders to run the business the way they see fit. If you don’t like the performance of a company, you sell your shares and choose a new home for your investment dollars. There are a host of safeguards available to investors today to not only understand the market but also invest well and manage risk well. Tools are essentially different orders you can place with your brokerage company to protect yourself like “take profit”, “boundary options”, “hedging” and “stop loss”. Social enterprises raise funds through issuance of instruments like Zero Coupon Zero Principal , donations through mutual fund schemes or other means specified by Sebi.

The Sensex has generally been a reliable indication of the health of the Indian stock market and has shown substantial long-term growth. The stock market, however, may be erratic in the near term, and previous success is not necessarily a reliable predictor of future outcomes. The stock market is a very volatile space changing every second, the price of a security can gap past the stop loss level, leading to slippage.

Means playing hot potato with stocks — buying and selling the same stock in a single trading day. Day traders care little about the inner workings of the businesses. They try to make a few bucks in the next few minutes, hours or days based on daily price swings.

Another really great option is investing through a Health Savings Account . You can only contribute to an HSA if you have a qualified high-deductible health plan . But if you do have one, you can invest money in an HSA and use those funds to pay for qualified medical expenses completely tax-free. Once you’re ready to invest, we recommend investing 15% of your gross income toward retirement. Misconceptions about the stock market—like thinking you don’t have enough money to start investing—stop some folks from investing for their future. Others are afraid of a stock market crash, and that fear keeps them on the sidelines.

After a stock is listed at an exchange, market forces take over. Some investors purchase the stock, or bid for it, at a low price. Being a successful investor doesn’t require finding the next great breakout stock before everyone else. By the time you hear that a certain stock is poised for a pop, so have thousands of professional traders. It may be too late to make a quick turnaround profit, but that doesn’t mean you’re too late to the party.

Michael earned an undergraduate degree in economics at the University of California, Berkeley. He volunteers as a University of California, Berkeley alumni ambassador. Michael is a certified financial planner and an IRS enrolled agent. Fee-only financial advisors charge annually and provide advice on selecting investments, or make the trades for you. National and regional economic factors – such as tax and interest rate policies – can influence changes in the market.

- First, you could open up a taxable brokerage account and invest there.

- Sellers will, therefore, ask higher prices for it, ratcheting the price up.

- Buys or sells the stock only at or better than a specific price you set.

If you’re looking for long-term growth, having more stocks in your portfolio could be a good strategy given their historically high rates of return compared to bonds. As the economy grows, public companies grow their revenue and profits, which causes the value of their shares to rise over the longer term, and their shareholders reap the benefits. Class B stock is held by the company’s founders and gets 10 votes per share.

If you find discrepancies with your credit score or information from your credit report, please contact TransUnion® directly. Investors often track the stock market’s performance by looking at a broad market index like the S&P 500 or the DJIA. The chart below shows the current performance of the stock market — as measured by the S&P 500’s closing price on the most recent trading day — as well as the S&P 500’s historical performance since 1990. This all may sound complicated, but computer algorithms generally do most price-setting calculations.

Private Companies

While the market’s history of gains suggests that a diversified stock portfolio will increase in value over time, stocks also experience sudden dips. 401 through your workplace, you may already be invested in the stock market. Mutual funds, which are often composed of stocks from many different companies, are common in 401s. For example, the S&P 500 has a historical average annualized total return of about 10% before adjusting for inflation. However, rarely will the market provide that return on a year-to-year basis. Some years the stock market could end down significantly, others up tremendously.

Adjusted per-https://forex-trend.net/ earnings came to $2.30, well ahead of the $1.62 FactSet consensus. Sign Up NowGet this delivered to your inbox, and more info about our products and services. Shares of the chip giant leaped more than 9% in early trading after Nvidia posted beats Wednesday on the top and bottom lines for its latest quarter. Wall Street praised Nvidia’s results Thursday, calling AI opportunities the next big growth vector for the chipmaker.